Are you invested in mutual funds? If so, you’re in good company. Over 46% of American households own mutual funds.

But do you know how much your mutual fund costs? That’s a much harder question. I’m sure 46% of Americans don’t know that one!

One of the key components of good stewardship is knowing where your money is going. That’s why having a budget is so important. Most things we spend our money on have a price tag, but mutual funds are a little bit more complex. Here is a breakdown of mutual fund fees, so that you have a better idea of what you’re spending on your investments and why.

Loads

Front-end loads are commissions or sales charges that you pay when you purchase shares of the mutual fund. If you buy an “A Share” mutual fund, that means you will be paying a commission, or front-end load.

A “B Share” mutual fund has a back-end load. That means that if you sell the shares within a certain timeframe, you will have to pay a deferred sales charge or surrender charge. While you always have to pay a front-end load, you can avoid paying a back-end load if you hold the shares long enough.

Loads can be anywhere from 0% to 6%. Zero percent funds are also called no-load mutual funds because there is no commission or sales charge when you buy or sell the fund. But that doesn’t mean they are free. This article explains how loads are calculated.

Management & Operating Expenses

Mutual funds also have ongoing fees that cover management and operating expenses. They are listed as a percentage of the account value and the fees are taken from the account on an annual basis.

The management fee compensates those who are managing the fund. That is why actively managed funds are usually more expensive than index funds. The operating expenses include things like record keeping, transaction costs, director’s fees, and legal and auditing expenses. All mutual funds have those expenses, even index funds.

12b-1 Fee

It may be hard to imagine, but there once was a time when people were not familiar with mutual funds. Back when the Securities and Exchange Commission (SEC) wanted to help get the word out about mutual funds, they allowed fund managers to use some of the fund’s assets to pay for marketing and advertising expenses. These are called 12b-1 fees and are rather unnecessary in today’s world. Yet they still exist. And they are typically found in “C Share” mutual funds and are charged on an annual basis.

Short-Term Trading Fees

Mutual funds are not checking accounts and their managers do not want you to treat them as such. They want you to put your money in and leave it there for an extended period of time. In order to encourage that, some mutual funds have short-term trading fees. These are basically extra fees that you have to pay if you withdraw your money within 30-90 days of investing it. Investing should be a long-term game, and if you treat it that way then you won’t have to worry about short-term trading fees.

Fee Schedule Example

Here is an example of a real life mutual fund fee schedule. It’s a screenshot of what they have listed on their website.

In the top right-hand corner, you can see that it is for A shares. As such, it lists sales charges that decrease the more money you invest. Next, it lists the ongoing expenses. There are management fees, 12b-1 fees, and “other expenses.” These are combined to create the expense ratio, which is the percentage of your account that you will pay on an annual basis. You will notice that even though these are A shares they still have a 0.25% 12b-1 fee. When I chose C shares in the top right corner the sales charges disappeared and the 12b-1 fee jumped up to 1%.

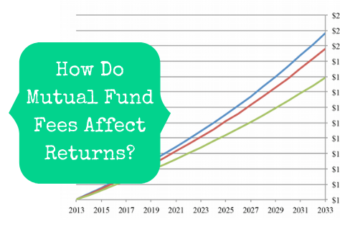

As you can see, there are a number of fees that you may end up paying when you invest in mutual funds. Make sure you are aware of all of the fees involved as you make your investment decisions. Also, compare fees among like funds. You would be surprised how the fees can vary by fund company for essentially the same investment, especially with index funds. Click here to learn more about the powerful way that fees affect your overall returns.