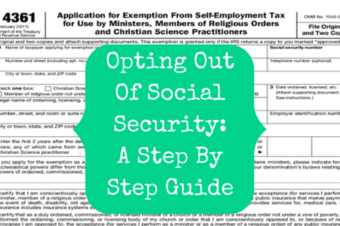

Q: I’m having an accountant do my taxes who I believe hasn’t done taxes for pastors before. This is my first year in full-time ministry. My accountant is under the impression from Form 4361 that I have to be in ministry for 2 years before I can file for tax exemption. My understanding is that I just need to file this form within 2 years of claiming exemption. Can you help clarify?

A: You are correct. You can file Form 4361 the day you become a licensed minister if you want to. After 2 years, you have missed your opportunity and will be a part of the Social Security system permanently. Until you have an approved Form 4361 from the IRS you will have to pay Social Security taxes, but they can be refunded once you have an approved exemption.

Q: My husband is on staff at a local church as a licensed minister. He has been on staff for less than 2 years. Prior to that, he was in corporate America for 35 years. I understand that he is now considered self-employed. Please tell me the pros and cons of opting out of Social Security taxes. If he opts out, can he still draw Social Security and Medicare at retirement age since he has paid in for 35 years? We were told that Social Security is calculated on the 10 highest earnings years of employment. Is this true? I have a Form 4361 to fill out and send in to the IRS. I would like information prior to submitting that request. I am getting conflicting information from our CPA and staff lawyer.

A: Your husband is considered self-employed only for Social Security & Medicare (payroll) taxes. If he receives a W-2 from his church, then for income tax reasons he is still treated as an employee. (Confusing, I know.)

As for opting out of Social Security, that will not affect his eligibility for benefits that he has already earned. Social Security benefits are calculated based on 35 years’ worth of earnings. The minimum you need to have worked is 10 years, but they take numbers from 35 years to calculate your average earnings.

If he opts out, then he will not have to pay any payroll taxes on his pastoral income. When filing taxes, he would just calculate income taxes from his W-2 as he has been doing all of these years. If he doesn’t opt out, then he will have to pay 15.3% of his income in payroll taxes. When filing his tax return, he will have to fill out Schedule SE to calculate those taxes. The church is not allowed to pay payroll taxes for him.

Q: I am a retired teacher of 31 years. I retired in 2010, and am currently collecting Social Security. I entered the ministry as a pastor in 2010 and currently am pastoring. My accountant said I should not pay self-employment because I have enough paid in. I am a bit nervous. Can I lose what I currently am collecting, Medicare, etc. by filing 4361?

A: Opting out of Social Security will not affect the benefits that you are currently eligible for. However, you are only allowed to opt out of Social Security for religious reasons or matters of conscience. The IRS spells it out very clearly that you are not allowed to opt out for economic reasons. Also, if you have been pastoring since 2010 then you are no longer eligible to opt out. You only have about 2 years after you enter the ministry to elect that option.

Q: I am applying for spousal benefits from my deceased wife’s Social Security. I have a small $8,000 401(a) where I work as a chaplain who opted out with Form 4361. The Social Security rep is telling me I may be subject to WEP/GPO reduction if my 401(a) is a pension.

A: The Social Security Administration’s Operations Manual clearly states that “A monthly periodic payment to a minister based on service as a minister is not considered a pension for purposes of WEP.” You can refer the SS rep to this webpage.

Q: I filed a Form 4361 after seminary. I worked as a sole proprietor in secular work for 20 years. Now (last 7 years) I am working for a non-profit religious organization and they have been making payments to Social Security. How do I know if these payments will be credited to my Social Security benefits or not? If I have the organization stop these how do I know the effect on my future benefits?

A: The best thing for you to do is to set up an account at ssa.gov where you can see your earnings history. That way, you will know the amount of income for each year that the Social Security Administration (SSA) is using to calculate your benefits. You can see if the payments your organization has been making are being credited.

The SSA calculates benefits based on your highest 35 years’ earnings. If you have less than 35 years, they just use zeroes for the extra years up to 35. So, fewer years of work or lower pay will result in lower benefits.

If you are working as a “minister of the gospel” for your current organization, then they are not supposed to be paying Social Security for you. The definition of “minister of the gospel” is the same for Social Security and the housing allowance, so you can learn more about that here.

Q: We have a pastor that was cut from salary to hourly wages. With now paying hourly wages, is the church responsible to pay half of the Social Security and Medicare taxes?

A: As long as the pastor is still functioning as a pastor, she is still responsible for paying her own payroll taxes regardless of the hours that she works. It is not the church’s responsibility.

Q: I am an ordained minister and I am a real estate agent. The income I receive as a minister is very little and the income I receive from the real estate work is better. I have 3 questions:

1. Do I file Form 4361 and WAIT for an approval response from the IRS before I can file my regular taxes?

2. If I get the 4361 approved, does that mean I can include this form every time I file my real estate taxes and then not pay taxes? Then I would not have to pay taxes from my real estate earnings.

3. Later on in future years, I understand that once the 4361 is approved we can file form 2031 to revoke the renouncing of receiving public insurance (Social Security). How difficult is obtaining the 2031 approval?

A: Here are the answers to your questions:

1. Go ahead and file your taxes as usual. Once your Form 4361 is approved, you can request a refund of any Social Security taxes that you have paid for your ministerial services up to that point. Because of the coronavirus, this year’s tax filing deadline has been extended to July 15, so you can wait up until then if you would prefer to wait.

2. Form 4361 only applies to your ministerial earnings. Your real estate income is subject to Social Security and taxed as usual.

3. Filing Form 2031 to opt back into Social Security is not currently an option. Several times over the past 50 years Congress has enacted a special rule where ministers had a one-time opportunity to opt back into Social Security with that form, the last time being in 2002. As such, I would not count on that option being available in the future.

Do you have a question? Feel free to ask!

Also, some of these questions should really show you the importance of working with financial professionals who understand clergy issues!

4 Responses

Mike

May 25, 2020I opted out of SS back when I first started in the ministry 40 years ago. I’m now 60. My wife has been a registered nurse for the past 19 years. She plans to work another 10 years. She has paid SS at a healthy level all those years. Even though I haven’t paid into SS can I receive spousal benefits when I’m 67 or will I be denied? Should I get a small part time job to have those benefits?

Amy

June 1, 2020Mike, you are eligible to receive spousal benefits based on your wife’s record. Check back next Monday, June 8, for an entire article covering that.

Dennis Stueve

May 25, 2020Great information as always! Thanks!

Amy

May 26, 2020You’re welcome, I’m glad you’ve found it helpful.